Law Firm Trust Accounting: The Dos and Don’ts for Every Firm

Rather than relying on manual tracking or generic accounting software that isn’t designed to meet the needs of the legal industry, use specialized legal trust accounting software. ReconciliationsThe reconciliation process requires a lawyer to compare the trust account bank statement, the client ledgers, and the general ledger and record any discrepancies among them. Performing the reconciliation provides third-party evidence—in the form of a trust bank statement—that a lawyer has maintained complete and accurate records of their trust account. As such, reconciliations should be performed on a monthly basis, when the trust bank statements are received. Segregate Client FundsA lawyer or law firm may maintain one trust account for all their clients’ trust funds.

Funds that should never be placed in a client trust account

- In addition to choosing the type of trust account to use, it’s recommended—and typically required to—open an account with a bank that participates in the Interest on Lawyer Trust Account (IOLTA) program.

- Can I manage my firm’s trust accounts manually, or do I need specialized software?

- Staying compliant while navigating a maze of rules and regulations is no easy feat.

- Failure to adhere to these guidelines can lead to ethical violations and undermine the program’s objectives.

- These funds must be held until they are used for a specific client’s case, and cannot be accessed any earlier.

- If you are audited by the state bar, you’ll want to make sure you can produce your trust balances on the fly in an easy-to-read format on a matter-by-matter basis.

Separate trust accounts, on the other hand, are established for individual clients, offering a clear, straightforward management of larger sums or when funds are held for extended periods. Attorneys sometimes report deposits made into a client trust account as their own income. This is a significant mistake, akin to confusing a client’s checking account with your personal funds. For example, law firms that handle real estate matters may require several pooled trust accounts at different financial institutions. On the other hand, a criminal practice may require only one pooled account. There are several other rules banks and firms must follow when managing IOLTA accounts.

Not Keeping Client and Business Accounts Separate

These statements are typically prepared monthly or quarterly and help maintain transparency, accountability, and compliance. Transfers between trust accounts or between trust and non-trust accounts must be executed in accordance with the trust agreement and applicable regulations. Proper documentation and assets = liabilities + equity authorization are necessary to prevent the potential misuse of trust funds.

- Attorneys might be tempted to ‘borrow’ money from the trust account during cash flow problems, thinking it harmless since the money will be theirs eventually.

- Many state bars offer resources, training, and updates to help lawyers maintain their understanding of trust accounting requirements.

- Especially if you’re keeping track of multiple client trusts, managing all of them can be fraught with potential challenges.

- These controls may include segregation of duties, authorization protocols, and reconciliation processes to ensure the integrity and security of trust accounts.

Our monthly reconciliations take less than a minute

Lawyers should address any trust accounting errors promptly, immediately conducting a thorough audit. Compliance with legal and regulatory requirements is critical to safeguarding trust assets, protecting beneficiary interests, and maintaining professional integrity. Failure to comply with laws and regulations can result in fines, penalties, or legal actions against trustees and trust account managers. Trust accounting must adhere to applicable laws, regulations, and professional standards to ensure proper administration, transparency, and accountability. The main benefit I have experienced with using TrustBooks is knowing that my trust account is 100% accurate – no more handwritten ledgers and trying to figure https://www.bookstime.com/ out which money belongs to which client each month. One of the core functions of a trust is to ensure that there is no commingling between client funds and the lawyer’s funds.

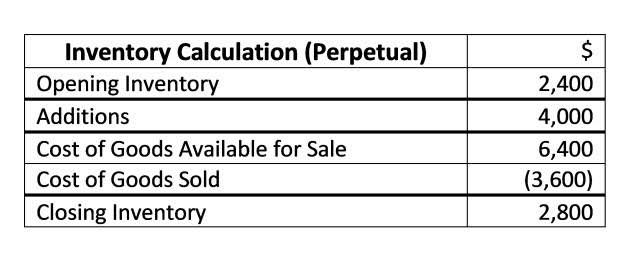

To help you get started, we put together a simple trust accounting template. Adjust the template to comply with your firm’s trust accounting process and local regulations. Depending on the software used for law firm accounting, trust funds can be placed into one trust liability account and tracked by the customer name or any other preferred method. Some states have laws and ethical rules regarding solicitation and advertisement practices by attorneys and/or other professionals. The National Law Review is not a law firm nor is intended to be a referral service for attorneys and/or other professionals. The NLR does not trust accounting for lawyers wish, nor does it intend, to solicit the business of anyone or to refer anyone to an attorney or other professional.

Why does a lawyer need a trust account?

Trust account audits and reviews involve an independent examination of trust account records and procedures to ensure accuracy, compliance, and proper administration. Audits and reviews help identify potential issues, improve trust management, and maintain professional integrity. Disbursements from trust accounts involve payments for trust expenses, distributions to beneficiaries, or other authorized expenditures. It is crucial to follow the trust agreement’s guidelines and maintain accurate records of all disbursements.

Resources to help with trust accounts

- Nearly every lawyer will be responsible for holding onto client funds at some point in their careers, so it’s important to stay current on how to do it right.

- We highly recommend electronically managing all trust fund accounting to avoid the mistakes of hand-written records.

- If your client disputes the fee you desire to draw from the funds deposited in trust, only the disputed portion need remain in the trust account until the matter is resolved.

- This includes understanding the nuances of IOLTA accounts, record-keeping standards, and reporting obligations.

Acceptable payments include, but are not limited to client costs and expenses, settlement proceeds, and legal fees. Payments may not exceed the amount of money available to the client in the trust account at the time of disbursement. Bank charges, such as monthly service fees, should only be paid out of a trust account if the attorney has deposited sufficient, personal funds to cover them. The importance of diligence in trust accounting for lawyers cannot be overstated. Regular audits, accurate record-keeping, and adherence to ethical guidelines are paramount. Mistakes in trust accounting can have serious repercussions, not only for individual lawyers but for the entire profession.

No Comments