Times Interest Earned Ratio

You’ll find articles on starting a small business, name registration, and more. Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University. Additionally the ratio is referred to as the interest coverage ratio.

Definition – What is Time Interest Earned Ratio?

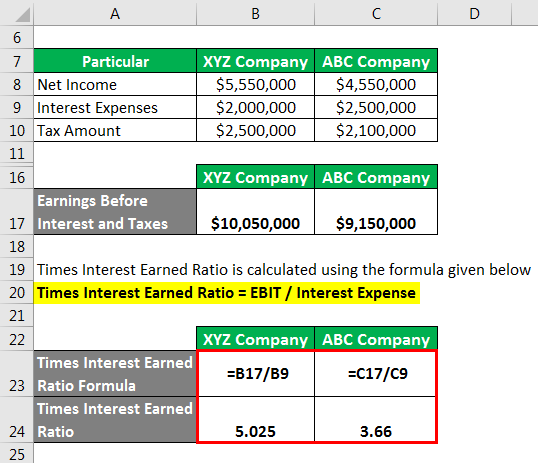

As with EBIT, this data is located on your income statement. The times interest ratio is stated in numbers as opposed to a percentage. The ratio indicates how many times a company could pay the interest with its before tax income, so obviously the larger ratios are considered more favorable than smaller ratios. The times interest earned ratio is calculated by dividing income before interest and income taxes by the interest expense.

What Is Times Interest Earned Ratio & How to Calculate It?

A TIE ratio of 2.5 is considered the dividing line between fiscally fit and not-so-safe investments. Lenders make these decisions on a case-by-case basis, contingent on their standard practices, the size of the loan, and a candidate interview, among other things. But the times interest earned ratio formula is an excellent metric to determine how well you can survive as a business. Earn more money and pay your debts before they bankrupt you, or reconsider your business model. This ratio is crucial for investors, creditors, and analysts as it provides insight into the company’s financial health and stability. A higher TIE ratio suggests that the company is generating sufficient earnings to comfortably cover its interest payments, indicating lower financial risk.

Interest expense example and time interest earned ratio derivation

The TIE ratio should be calculated regularly, such as quarterly or annually, to monitor changes in a company’s financial health over time. The times interest earned ratio looks at how well a company can furnish its debt with its earnings. It is one of many ratios that help investors and analysts evaluate the financial health of a company. The higher the ratio, the better, as it indicates how many times a company could pay off its debt with its earnings. A TIE ratio of 11 indicates an even stronger financial position than a ratio of 10.

Calculating total interest earned

The TIE ratio is crucial for assessing a company’s financial health and risk level, particularly in terms of its ability to pay off interest on its debts. By comparing a company’s earnings before interest and taxes (EBIT) to its interest expenses, the TIE ratio offers a clear picture of financial health. A higher ratio indicates stronger financial stability, while a lower ratio may signal potential difficulties in meeting interest payments.

- Again, there is always more that goes into a decision like this, but a TIE ratio of 2.5 or lower is generally a cause for concern among creditors.

- When you sit down with the financial planner to determine your TIE ratio, they plug your EBIT and your interest expense into the TIE formula.

- Our comprehensive collection ensures that users can find the perfect tool to meet their needs, no matter how niche or complex.

- You have a company credit card for random necessities, with a current balance of $5,000 and an annual interest rate of 15 percent.

Formula To Calculate Times Interest Earned Ratio (TIE) :

This also makes it easier to find the earnings before interest and taxes or EBIT. This tool is used to calculate the company times interest earned ratio based on earnings before interest taxes and interest expenses instantly. Times interest earned ratio is a debt ratio whose purpose is to allow investors and creditors to measure the level of financial risk the company has. To improve its times interest earned ratio, a company can increase earnings, reduce expenses, pay off debt, and refinance current debt at lower rates. The ratio does not seek to determine how profitable a company is but rather its capability to pay off its debt and remain financially solvent. If a company can no longer make interest payments on its debt, it is most likely not solvent.

One goal of banks and loan providers is to ensure you don’t do so with money or, more specifically, with debts used to fund your business operations. Not only does this translate into more money available to repay the principal on its loans, it also means there’s more cash to put toward expanding operations and increasing investor value. When you use the TIE ratio to examine a potential investment, you’ll discover how close to the line a business is running in terms of the cash it has left over after its interest expenses have been met. In conclusion, as it is always said, it is vital to understand what you are paying for when you invest.

Also known as the interest coverage ratio, this financial formula measures a firm’s earnings against its interest expenses. This crucial financial metric empowers you to make informed assessments of your company’s what is considered a qualified education expense and what can i claim ability to cover interest expenses with precision. The TIE ratio only focuses on interest coverage and does not account for other financial obligations, such as principal payments or operating expenses.

Our goal is to provide a one-stop solution for all your calculation needs, eliminating the hassle of manual calculations or searching for multiple tools across the web. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting.

It is calculated by dividing a company’s earnings before interest and taxes (EBIT) by its interest expense within a specific period, typically a year. With our times interest earned ratio calculator, we strive to assist you in evaluating a company’s ability to meet its interest obligations. For further insights, you might want to explore our debt service coverage ratio calculator and interest coverage ratio calculator. The Times Interest Earned Ratio is a valuable financial metric for both investors and creditors, helping assess a company’s ability to manage its interest payments. Our Times Interest Earned Ratio Calculator simplifies the calculation process, making it easier to evaluate a company’s financial health. The times interest earned calculator calculates the times interest earned (TIE) ratio.

No Comments