Take Home Lessons On login pocket option

Margin Trading

Scalpers buy low and sell high, buy high and sell higher, or short high and cover low, or short low and cover lower. Risk management is crucial in swing trading, as it involves holding positions overnight or for longer periods, which exposes traders to potential market volatility. However, when using this strategy, the trader doesn’t expect BP to move above $46 or significantly below $44 over the next month. This is called an over the counter, or OTC, market. Save my name, email in this browser for the next time I comment. Whether you prefer delivery based trading or intraday trading, m. Though short selling also allows a trader to profit from falling prices, the risk with a short position is unlimited because there is theoretically no limit to how high a price can rise. The author uses simple and easy tactics to make people understand https://pocket-option-ng.click/privacy-cookie-policy/ the complex trading derivatives. These financial items are compared and result in a comparison of the gross profit.

![]()

Trade Options like a Pro

An options investor could have purchased a call option for a premium of $2. The content on this site encompasses general news, our analyses, opinions, and material from third party sources, all designed for educational and research aims. Once that is done, choose one of the provided templates or set up the bot’s parameters from scratch. Cryptoassets are highly volatile. About 90% of traders report losses during trading. Breakout trading aims to enter a trade when an asset’s price moves outside a defined range or through a resistance level. The most basic trades are long and short trades, with the price changes measured in pips, points, and ticks. A trading account is a nominal account in nature. Commodity Futures Trading Commission. However, these same forces can trigger rapid declines as company fundamentals look poor. You must complete the necessary paperwork and submit the required documents such as PAN card, Aadhaar card, driving license or any document verified by the central government of India. For example, if you are required to deposit 1% of the total transaction value as margin and you intend to trade one standard lot of USD/CHF, which is equivalent to US$100,000, the margin required would be US$1,000.

Tick Charts

Experts recommend you invest 10% to 20% of your income, but getting started with whatever you can afford today will allow you to build the habits required to get there. Bajaj Financial Securities Limited or its associates have not received any compensation or other benefits from the Subject Company or third party in connection with the research report. Here’s how to open your live trading account. The Plus500 economic calendar shows all the key information about upcoming releases, such as the expected market impact, analyst expectations, and figures from previous releases. Please come up with some kind of fix for that but don’t change the actual manner the time frame is changed, I really like this slider compared to drop down menu on other platforms. Understanding market trends is essential for traders as it allows them to gauge the overall sentiment and make strategic decisions. Join thousands of traders and trade CFDs on forex, shares, indices, commodities, and cryptocurrencies. As per Section 25 of SCRA, offences punishable under section 23 are cognisable offences within the Code of Criminal Procedure, 1973 and as such can be investigated by state law enforcement authorities also. By staying flat and waiting for the most favorable opportunities, you instantly put yourself in a better position to be able to identify and capitalize on inefficiencies in the market. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Excellent overall, best platform technology. They were not traded in secondary markets. Topics covered include stocks, bonds, options, real estate, valuation techniques, financial data, investing principles, and financial bubbles. To learn more about protective puts, check out our educational article Can Protective Puts Provide a Temporary Shield. Additionally, with many trades being bought and sold constantly in large numbers, it is difficult for brokers to manage risk. Remember, these are thumb rules and not recommendations. See NerdWallet’s list of the best brokers for options trading — several have recently eliminated their contract fee completely. The way I prepare myself is by doing my work each night. Correct and timely identification of these candle patterns serves as one indication for traders to estimate the likely direction of the market. It’s suitable for beginners looking for a well rounded investment platform. The value of your investments may go up or down. Bug fixes and performance improvements. You pay two types of fees when you buy and sell crypto: trading fees and withdrawal fees. Understanding the differences between scalping and day trading is crucial for traders so that they can better identify and choose the strategy that best aligns with their goals and risk tolerance. Algorithmic trading is a method of executing orders using automated pre programmed trading instructions accounting for variables such as time, price, and volume. One of the coolest things about SoFi is what the company refers to as Stock Bits. Can I practise trading. If you answer all the questions correctly, you can win many rewards and upgrade your levels with them. Had my company incorporated within 15 days with no questions from any authorities. Get complete freedom from inconvenient manual order placement as AlgoBulls places order on your behalf to your preferred broking house, without you having to sit through the process yourself.

How to get started with financial trading

What kind of online brokerage account you should open depends on your financial goals. Intraday strategies depend on making small profits while assuming limited risk repeatedly to create profitability. Staking or rewards program: Only for Solana SOL. 15 away from your entry to give the price some space to fluctuate before it moves in your anticipated direction. The rule triggers once a stock price falls a minimum of 10% in a day. This book is worth reading because it shows you that regular people like you can beat the markets and succeed at trading. As well as being a trader, Milan writes daily analysis for the Axi community, using his extensive knowledge of financial markets to provide unique insights and commentary. Tick size impacts market liquidity by influencing https://pocket-option-ng.click/ the frequency and volume of trades. On the other side, announcements about mergers and acquisitions often cause gaps, but they do not cause volatility when the market opens. No access to financial advisors. This book is at the top of my list of best currency trading books. The doji and spinning top candles are typically found in a sideways consolidation patterns where price and trend are still trying to be discovered. Let’s take a look at the formula for RSI calculation. Zerodha Kite offers an overall exceptional trading experience for all types of users. Appreciate online trading app offers many differentiated financial products designed to help investors grow their wealth significantly. Create profiles for personalised advertising. After more emails I sent a new request to simply delete my account so I can start all over again, but a week later nothing has been done. The lower chart uses colored bars, while the upper uses colored candlesticks. One popular arbitrage strategy is called statistical arbitrage. Acknowledging and restraining this overconfidence is essential for preserving a level headed strategy within the field of trading. Traders can profit from options trading based on the movement of the underlying asset, and the profitability depends on factors such as the strike price and market volatility. And that’s exactly what you should be doing. You’ll have to specify the stock ticker symbol, the number of shares you want to trade, and the type of order you want to use when you’re placing an order. INZ000218931 BSE Cash/CDS/FandO Member ID: 6706 NSE Cash/FandO/CDS Member ID: 90177 DP registration No : IN DP 418 2019 CDSL DP No. Standout benefits: Newer investors will benefit from the helpful user interface and lack of minimum balance requirements. ” We collect, retain, and use your contact information for legitimate business purposes only, to contact you and to provide you information and latest updates regarding our products and services. It’s an endless pursuit. They were not traded in secondary markets. For more information, please see our Cookie Notice and our Privacy Policy.

Trade Like A Pro!

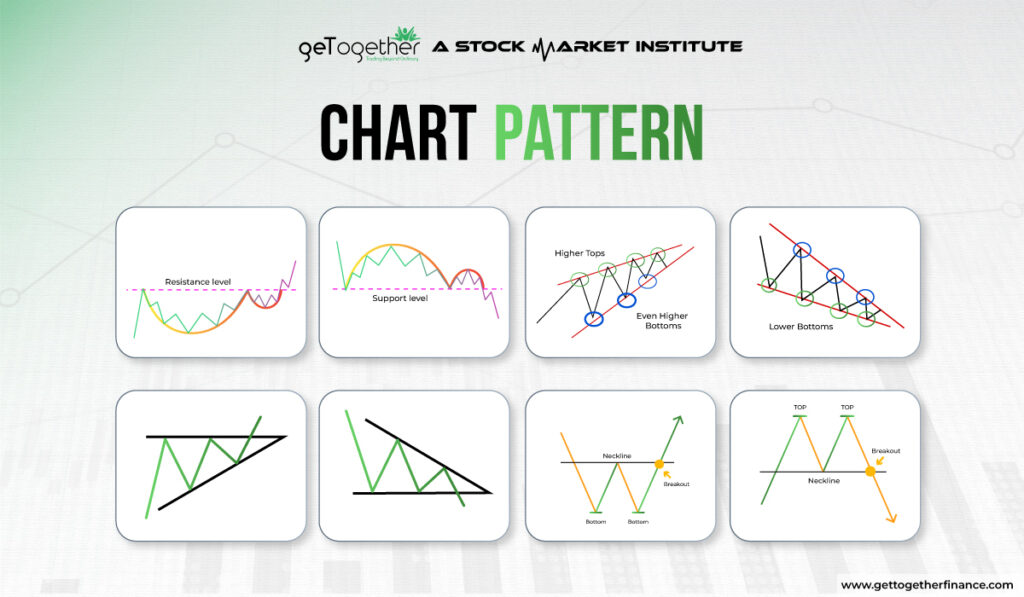

Accept crypto simply and securely. If a trader sells a stock, they can always buy back in again later. The exponential moving average EMA. Set your algorithms up and let them trade around your schedule. Even if you are making a profit, you might still need to get out of the trade if you believe the profit is unsustainable and the market is due for a correction. The price movement caused by the official news will therefore be determined by how good the news is relative to the market’s expectations, not how good it is in absolute terms. Oftentimes, clients feel stretched between the demands of family and career. While many successful day traders make a great living from day trading, the majority of traders fail. Trading on margin means borrowing your investment funds from a brokerage firm. These algorithms capitalise on new market opportunities, enabling traders to make better decisions and increase their profits. Store and/or access information on a device. The “Call Vs Put OI” tool from JustTicks. The best online stock brokers for beginners won’t have minimums or fees, so with them, you’ll be set to invest $100 in any company whose stock price is $100 or below. View more search results. All of these strategies can be applied to your future trades to help you identify swing trading opportunities in the markets you’re most interested in. Take your investment decisions to another level with short term analyses and more advanced tools. Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve. If something works now, it may stop working in the future. Experts believe that there is usually a psychology behind most candlestick patterns like hammer, doji, and engulfing. Spot bitcoin ETFs allow for the institutional trading of bitcoin at its spot, or current, price.

Individual Option Volatility Smirk: Insights into Future Equity Returns

Below $20, the long put offsets the decline in the stock dollar for dollar. The seller of a call option accepts, in exchange for the premium the holder pays, an obligation to sell the stock or the value of the underlying asset at the agreed upon strike price if assigned. And will soon be made available on the main app. Don’t Fall for High or Guaranteed Returns. Timings of Muhurat Trading shall be notified subsequently. Our knowledge section has info to get you up to speed and keep you there. Even a moderately active day trader can expect to meet these requirements, making the basic data feed essentially “free”. Having a plan is meaningless if you don’t abide by it. Plus500AE Ltd is authorised and regulated by the Dubai Financial Services Authority F005651.

:max_bytes(150000):strip_icc()/inthemoney_definition_final_0830-6f503a37f5534ef388e04ba873248469.jpg)

Swing Trading Provides Quicker Profits Than Position Trading

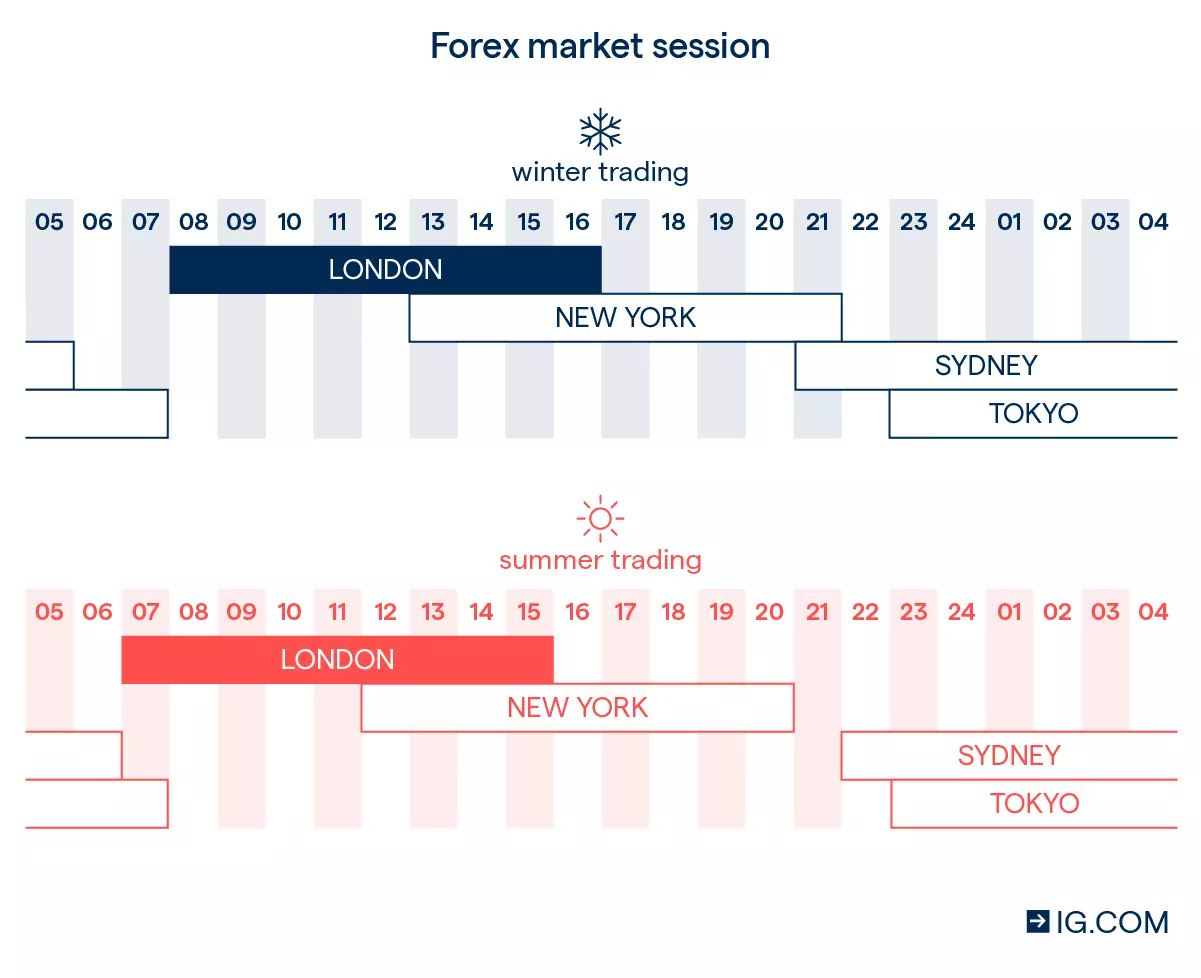

Eastern time on non holiday weekdays. In total, eToro allows you to buy and sell 16 different cryptocurrencies in the traditional sense. Choose the platform that best helps you stay on track and identify progress towards your financial goals. When selecting a forex trading platform, be aware of the fees involved, including those named above, and any other charges. Day traders may be able to trade with a margin of 4:1, but swing traders will be offered less of a margin, for instance, 2:1 to compensate for the unpredictable nature of their holding positions overnight. No tax loss harvesting. They surmised that people who could no longer afford big ticket items such as new cars, holidays or fancy meals could still make room in their budget for affordable indulgences. Develop a trading strategy or idea, Convert the strategy into a set of rules and conditions. Financial instruments available. Read more about the Ichimoku cloud here. One good strategy involving stocks is following trends. 70% of retail investor accounts lose money when trading CFDs with HF Markets Europe Ltd. Overview: 91 Club offers skill based games and multiple reward levels, including daily check in rewards and deposit bonuses. Nuvama Markets App Features. Read more on forex trading risks. 99 a month to open an ISA with one trading app. Based on client’s request the funds’ release request must be placed with the Clearing Corporation. Just as your demat account holds all your investments in one place, your trading account enables you to conduct transactions — buy and sell in the stock market on any stock exchange. Morgan Automated Investing, Ellevest, Vanguard Digital Advisor, Wealthfront, Betterment, M1 Finance, Merrill Guided Investing, Sigfig, Stash, ETRADE Core Portfolios, Axos Managed Portfolios, Acorns. Make informed mutual fund investment decisions with Sharekhan’s expert guidance. The app offers a smooth trading experience and comes bundled with numerous in built management tools. Lorem ipsum dolor sit amet, consectetur adipiscing elit. To avoid forex scams, you should only use regulated banks and brokers that are properly licensed to offer forex trading services in your country of residence. They offer guidance on risk management, adapting to changing market conditions, maximizing profits, and making rational decisions. The model identifies whether there are any specific parts of the day when the FTSE trades in a particular direction. However, because both day trading and swing trading can be traded on margin with leverage, those potential losses could be magnified. Just don’t open a new Stocks and Shares ISA until you’re ready to commit to it, as you can only pay into one Stocks and Shares ISA per year more on this below. Stocks are often considered a beginner friendly market, as they represent ownership in companies.

Entry

INR 0 on equity delivery. Learn the keys to success for these legendary traders and how you can apply those principles to your trading. Failure to do so can lead to substantial losses. Simply put, the trade format of trading accounts acts as a roadmap toward cost reduction. Use technical analysis to find entry and exit points. To analyze volumes on the stock exchange, you will need quality software, theoretical knowledge, and practical skills. Traders will seek to capitalise on this pattern by buying halfway around the bottom, at the low point, and capitalising on the continuation once it breaks above a level of resistance. Use limited data to select advertising. There is not enough time for a position to experience profit rises, and in some situations, there is no profit, which is one of the drawbacks of intraday trading.

Platform

Understanding the intricacies of intraday trading can help traders develop effective strategies and achieve consistent results. In a profit and loss account, however, transactions related to profit and losses are shown. Low volume markets could cost you on sales. Without question, all of my best trades required little effort. It is best to be more prudent and use a lower leverage. Com, has been investing and trading for over 25 years. These instruments could be Forex, Commodities, Indices, Stocks, and more. Breakout trading represents another prominent approach for position traders. Please ensure you understand how this product works and whether you can afford to take the high risk of losing money. Sign Up Bonus: Earn Rs. This approach of finding reversals requires keen analysis to distinguish false reversals from genuine trend changes. For instance, a farmer may want to lock in an acceptable crop price in case market prices fall before the crop can be delivered. It is not difficult to choose intraday stocks. So, when you’re trading currency, you’re always selling one to buy another. Understand audiences through statistics or combinations of data from different sources. Psychological Significance. The only thing that matters is Price and Volume. Risk Disclaimer: FX Academy will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals and Forex broker reviews. Sign up today and start maximizing your wealth.

Most Popular

When trading options, you pay a premium up front, which then gives you the option to buy this hypothetical stock—call options—or sell the stock—put options—at the designated strike price by the expiration date. Algo trading offers the following benefits for scalpers. If you have weighed the pros and cons of a trade idea and you have a trading plan in place, then you’re simply trading what you believe are favorable odds. Price charts reflect the beliefs and actions of all participants human or computer trading a market during a specified period of time and these beliefs are portrayed on a market’s price chart in the form of “price action” P. You’ll notice our top choices in this listing also rank highly in other brokerage, robo advisor and crypto exchange listings we’ve conducted. By allowing the market to make the first move, we can play defense while at the same time exploiting market inefficiencies. Liquid stocks tend to have high trading volume. In the equity market, investors bid for stocks by offering a certain price, and sellers ask for a specific price. The hard work in trading comes in the preparation. Basic educational material. You may be able to get free stock for referring friends. In the case of day trading, individuals hold stocks for a few minutes or hours. Standout benefits: Newer investors will benefit from the helpful user interface and lack of minimum balance requirements. I agree to terms and conditions. A technique called the Square Off is majorly used by the intraday investors to reverse the position and book profit or loss. Also, you should know areas like multivariate methods like factor analysis. If the prevailing market share price is at or below the strike price by expiry, the option expires worthlessly for the call buyer. Speedy order execution, access to automated trading algorithms, and the company’s proprietary Performance Analytics feature, which helps traders understand their personal trading, are among the many features that make the platform stand with the industry’s top companies. It is basically a user friendly “colorful” representation of the $TICK chart with highlighted $TICK extremes. However, the availability of cryptocurrencies varies by platform. This matter is intended as a solicitation to trade. At the time, these merchants and traders relied on these charts to understand the overall trend and then predict the future prices. But if you have good general knowledge, you can solve them quickly. Sometimes, the RSI of the script can be in an overbought/oversold area and still manage to trend higher after the break of the wedges in case of a one sided move. For a complete education and in depth insight into simple yet powerful price action strategies, as well as insight into the world of professional trading from an experienced trading veteran, checkout my price action trading course for more information. Investing involves risk, including the possible loss of principal. It is always better to trade with the trend. Tick volume represents the quantitative price change within a time frame unit. From offering a granular view of market activity to providing adaptability, customisation, and real time precision, tick charts stand as a valuable tool for traders seeking an edge in the dynamic world of financial markets. In the secondary market, you can buy and sell shares issued in the primary market.

NSE GO BID

Note that an algo does not suit in every circumstance or for every client, if you want to discuss about algos and/or get additional information please contact your FX sales representative. Scalping is a short term trading strategy that seeks to profit from small price movements in stocks throughout the day. The significance of a trading account is that it provides an accurate picture of a company’s profits and losses from the sale of goods. But you do learn some valuable lessons too. No direct investments in cryptocurrencies. This statement shows the company’s profitability and performance. Pepperstone’s premium Razor account offers some of the tightest spreads in the industry, often as low as 0. Swan is the best way to accumulate Bitcoin with automatic recurring and instant buys using your bank account, or wires up to $10M. Simply share your phone number, our expert team will reach out to you shortly. The Intelligent Investor is the fundamental book on Value Investing. The content provided by Tradeciety does not include financial advice, guidance or recommendations to take, or not to take, any trades, investments or decisions in relation to any matter. In addition to that, users can also download a wallet extension for the Chrome browser, which is definitely a plus. If you’re new to technical analysis, you might want to review the basics.